What is Curve Finance?: The Stablecoin Liquidity Protocol

Curve Finance is a decentralized exchange(DEX) and liquidity procedure constructed on the Ethereum network. It’s frequently utilized to switch stablecoins with low charges and slippage, in addition to a location to deposit cryptocurrencies into liquidity swimming pools to make trading charges.

Our Curve Finance guide will break down whatever Curve Finance for you; we’ll stroll through how Curve functions, what liquidity swimming pools and AMMs are, how users generate income with Curve, and how the platform compares to other decentralized exchanges.

However, it’s essential to be clear that cryptocurrency is naturally dangerous, and DeFi items such as Curve are unique and speculative in nature. The innovation is extremely fascinating and can be disproportionately crippling or profitable– acknowledge the threats progressing.

Explaining Curve Finance

Curve is a decentralized exchange that permits users to switch numerous stablecoins, that much we currently understand.

While 2 or more stablecoins ought to remain in the very same dollar variety (1 USDC=1 USDT), there’s constantly some level of slippage when switching in between 2 of them The bigger the amount, the greater the slippage.

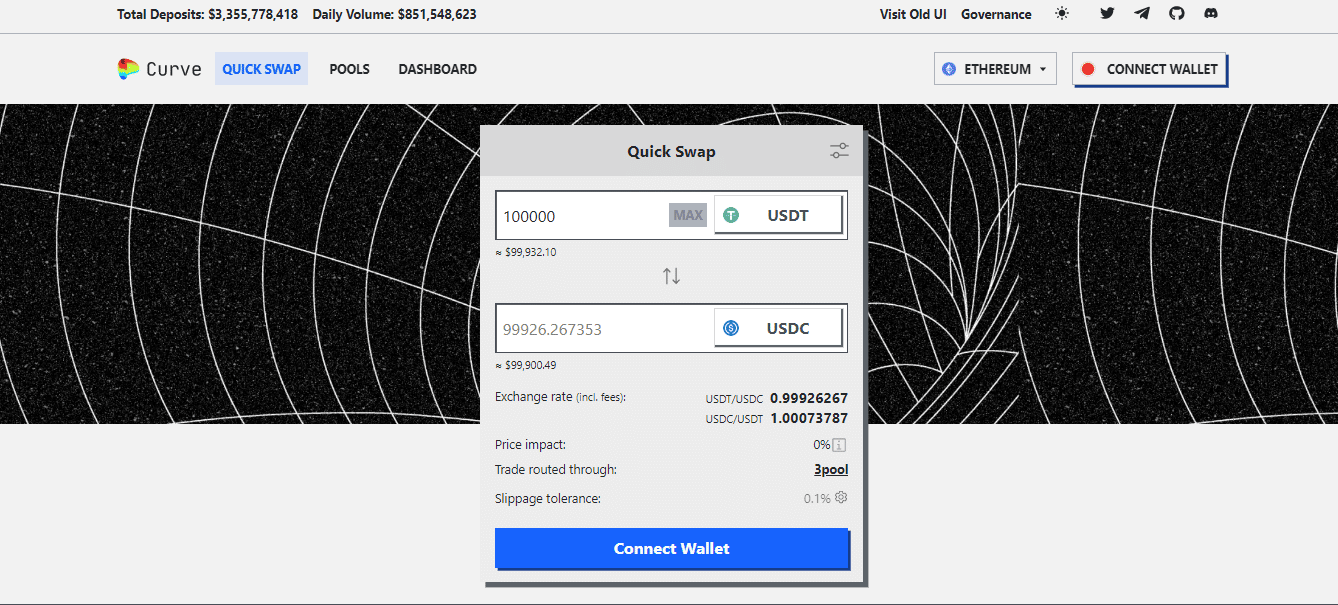

For example, if you wish to trade 100,000 USDT for 100,000 USDC, you might just wind up with 99,900 USDT due to slippage.

Curve utilizes the Curve Constant formula, comparable to that of Uniswap’s, to reduce slippage and trading charges.

The opposite of Curve is the liquidity procedure, and it’s much better to comprehend what automated market makers (AMMs) are and how they operate in decentralized exchanges:

- Curve depends on an AMM, which is a software application system that prices estimate rates in between 2 various properties utilizing a mathematical formula. When it comes to Curve, it prices quote costs in between 2 stablecoins or covered variations of cryptocurrencies, like covered Bitcoin (wBTC) and covered Ethereum (wETH).

- AMMs are various from order books, which are generally utilized by central exchanges (CEX), in the sense that they depend on liquidity service providers, which are the users, and other DEXs. Both users and DEXs deposit cryptocurrencies into one or several liquidity swimming pools to show a well balanced rate in between one or numerous possessions.

- In contrast, a central exchange utilizing the “ order book” method will have a deep swimming pool of possessions in its custody if required to offer liquidity for different trading sets.

Liquidity service providers are the foundation of decentralized exchanges; without them, a DEX would be illiquid and not able to satisfy trades at affordable costs. Considering that a DEX does not hold custody of its users’ possessions, it needs to offer rewards for them to offer liquidity.

Yield farming is the act of supplying liquidity– transferring funds– into a liquidity swimming pool so other users can make trades with numerous possessions. The procedure then pays a portion of trading costs to liquidity suppliers as a reward.

Like a lot of liquidity procedures, the quantity of costs ( the average is 0.04%) paid to liquidity suppliers depends upon trading volume; the greater the volume, the greater the costs, and for that reason the greater the APY (Annual Percentage Yield).

Curve’s site appears like an easy Web1 user interface from the late 90 s, however it’s reasonably simple to browse when you get utilized to it.

To utilize Curve, you require to link your cryptocurrency wallet, like MetaMask, Coinbase Wallet, or WalletConnect.

The very first area we’ll see fasts Swap, which permits you to switch over 100 possessions consisting of stablecoins and covered coins.

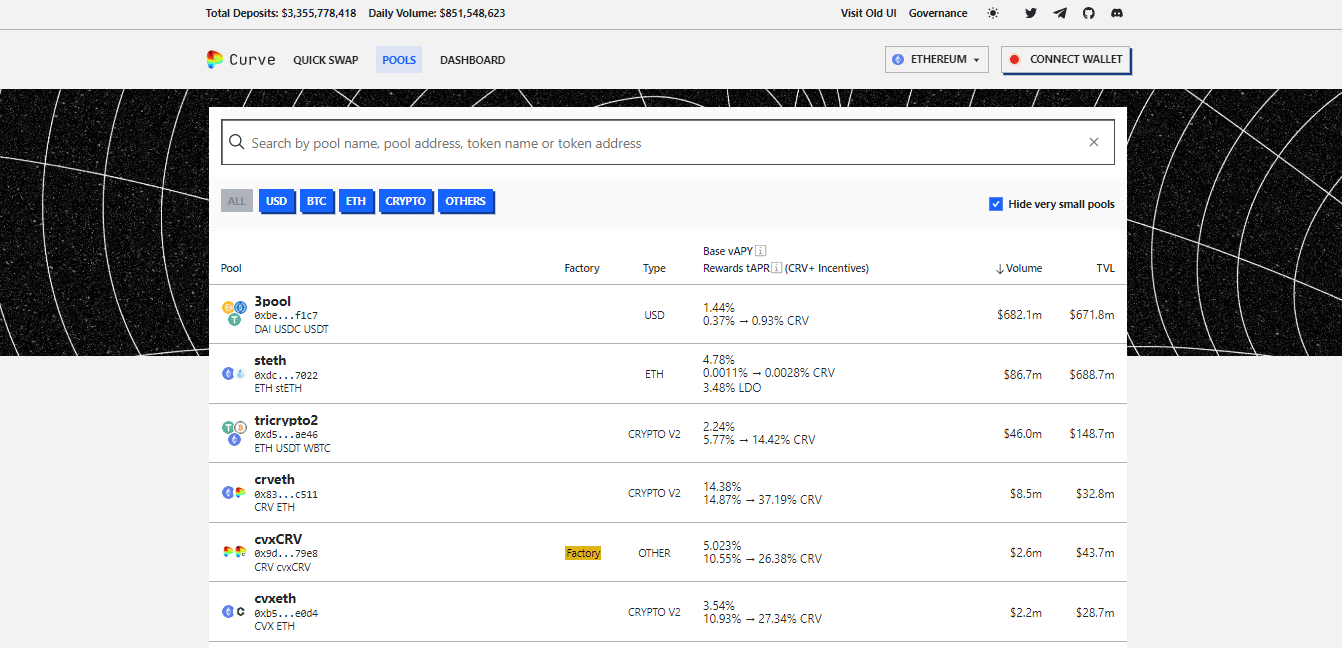

The area will reveal you the exchange charges, and the swimming pool in which the exchange will happen. If we switch USDT to USDC, the procedure will path it on 3pool, which has the biggest volume and TVL (Total Value Locked) for DAI, USDC, and USDT.

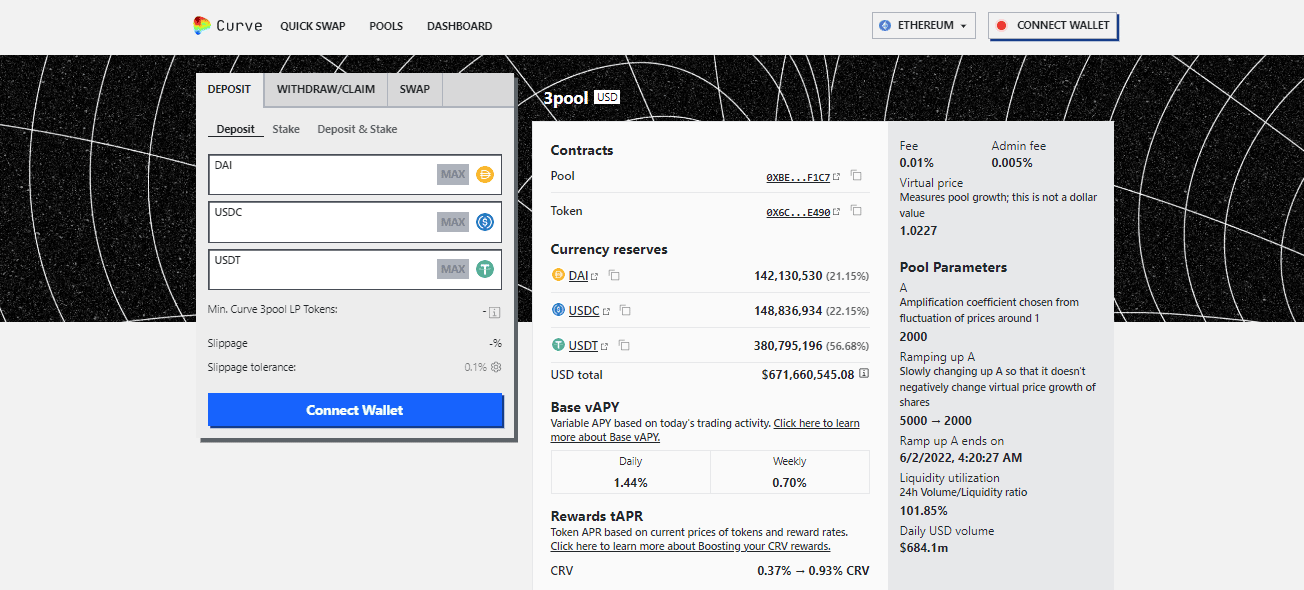

To inject liquidity to a swimming pool, just pick a swimming pool from the list and click Deposit. A deposit user interface will appear with various coins to deposit. The procedure rewards you with a deposit reward if you supply liquidity to the cryptocurrency with the most affordable balance. In this example, DAI.

There are 2 methods of transferring: regular deposit, and stake & & gauge, which stakes your tokens without lock-up durations, so you can unstake them whenever you want to. This alternative permits you to make CRV tokens as benefit, however you still get a part of trading charges.

Curve vs. Balancer

Both Curve and Balancer work as decentralized exchanges and AMMs with rebalancing systems. The primary distinction in between the 2 is that Curve utilizes stablecoins and covered variations of Bitcoin and Ethereum.

When a user transfers a DAI to a USDT/DAI swimming pool, then the swimming pool ends up being out of balance considering that the DAI balance is larger than USDT. The procedure then offers DAI at a minor discount rate in concerns to USDT to stabilize the USDT to DAI ratio. In this example, volatility and impermanent loss are decreased because the procedure is dealing with stablecoins.

On the other hand, users transfer 2 or more cryptocurrencies into a Balancer liquidity swimming pool wishing to make the most of returns with the fundamental threat of volatility. Balancer swimming pools can be made up of approximately 8 cryptocurrencies, while Curve swimming pools normally host 3 stablecoins.

The CRV Token & & Ways to Earn Yield by Staking, Vote Locking, and Voting

CRV is an ERC-20 token that has 3 primary usages:

- Staking: users secure CRV to make trading charges from the Curve procedure. The basic APY is 4%

- Vote locking: securing CRV for a particular duration and getting vote-escrowed CRV (veCRV), which are tokens that offer users voting power and an increase of approximately 2.5 x on the liquidity they supply to Curve’s liquidity swimming pools.

- Voting: The Curve DAO is where users vote on network criterion modifications or send their own propositions.

The CRV preliminary supply is 1.3 billion tokens, and the overall supply is topped at 3.03 billion tokens.

The circulation of CRV is as follows:

- 30% to the advancement group and financiers

- 60% to liquidity suppliers

- 5% to pre-CRV liquidity companies, 1-year vesting

- 5% to the neighborhood reserve

Curve’s Main Competitors

Balancer: a self-balancing property management platform that works likewise to a standard index fund however with decentralized functions. Its swimming pools are divided into public, personal, and clever classifications and can accommodate approximately 8 cryptocurrencies.

SushiSwap: a leading decentralized exchange developed on the Ethereum network and a fork of a widely known DEX in the DeFi area, Uniswap

PancakeSwap: a DEX constructed on top of the Binance Smart Chain(BSC), and supports other networks such as Ethereum and Aptos. It likewise incorporates a market where users can note, purchase, offer and trade non-fungible tokens (NFTs)

Osmosis: a popular DEX and advancement platform constructed on the Cosmos blockchain, enabling users to negotiate cryptocurrencies through various blockchains and to develop Web3 applications utilizing SDK and other designer resources.

Curve’s Founding Team

Michael Egorov developed Curve in January2020 Prior to Curve, he developed and led NuCypher and LoanCoin. Information about the advancement group are limited, so no one actually understands thorough who else worked on the development of Curve.

Curve is among the biggest automatic market makers (AMM) by market cap, sitting at the 4th area with a market cap of over $510 million, according to CoinGecko

Final Thoughts: Ahead of the Curve

Yield farming is a popular practice in the DeFi area, where liquidity service providers aim to put their tokens to work by transferring them into liquidity swimming pools. In DeFi, with terrific APY comes fantastic danger, such as volatility, impermanent loss, rate crashes, platform disaster, and even hacks.

Therefore, considering that Curve prefers stability over volatility, those who wish to leap in on the insane world of yield farming however have a lower hunger for threats can discover Curve as an useful alternative to beginning point.

Never Miss Another Opportunity! Get hand chosen news & & details from our Crypto Experts so you can make informed, notified choices that straight impact your crypto earnings. Subscribe to CoinCentral totally free newsletter now.